Important Dates & Grant Management Instructions:

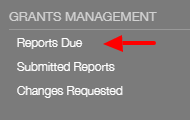

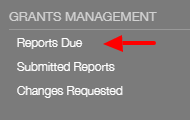

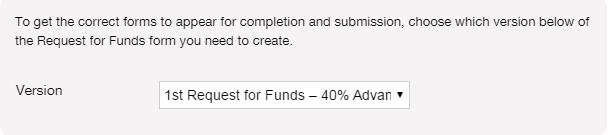

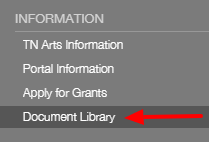

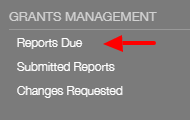

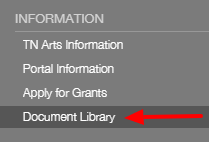

Grant award and denial emails are sent to all applicants on or around June 2, 2023. If you do not receive an email notify Commission staff. If awarded funding, the digits within your application identification number (for example, #A-1801-02248) will become the identifying numbers associated with the award. It may also be referred to as your Grant number or your Tracking/Contract number. The preceding letter may change. Award emails include instructions on how to accept the award. To accept the award you must first submit a correct and complete Revised Budget Form by June 15, 2023. You are encouraged to submit it as soon as possible. Upon receipt and approval, a contract will be generated for your award and emailed to the primary signatory listed on your application. How to submit a Revised Budget Form Revised Budget Forms will be found in the Grants Management – Reports Due link in the left-hand menu of the Online Grants System. The forms in this portal do not auto-save. Always click the “Save” button before navigating away from the form you are editing to save your work. Beware—clicking the back navigation button on your web browser will exit you from the system, and you will lose your work. Instructions: Budget Change Requests. Grantees may require changes to the budget and/or scope of their FY2024 project grants as submitted. Changes will be considered and approved on a case-by-case basis as long as the overall spirit of the proposed project reviewed by the grant panel remains consistent. While filling out the Revised Budget for your award, you may be aware of the need to adjust your project. Please briefly describe your requested changes in the text box provided and make appropriate revisions to your budget. Your program director will contact you if additional information is needed. If you have questions about completing the required information, contact the appropriate program director or the grants management director. No grant contracts will be issued until this form has been received. Failure to submit your Revised Budget by June 15, 2023 date may result in the cancellation of your award. Annual Grant contracts must be electronically signed and submitted. No grant funds may be obligated toward the funded project until a contract between your organization and the Commission has been executed and approved by all parties. Upon receipt of a correct revised budget a contract will be generated for your award and an email from DocuSign will be sent to the primary signatory listed on your application. Please inform the primary signatory about this email. When received, please review the contract and budget for this award. How to use DocuSign to reply to a request for an electronic (digital) signature Read through the contract carefully. If you have questions, please contact hal.partlow@tn.gov or 615-741-2093. If there are no questions, please proceed to sign. You should now see a message from DocuSign that “You have successfully signed your document using DocuSign.” After you successfully submit a signed contract it will be routed for TN Arts Commission signature. An executed copy will be returned to you via DocuSign email and uploaded into your grant file in the Tennessee Arts Commission online grant system. Failure to Return a Contract by June 30, 2023 FY2024 Title VI annual training must be completed after July 1, but before an organization submits its first request for payment from the Tennessee Arts Commission. All grant funds will be held until training requirements are met. If you are an Annual grant recipient who will not request an initial Request for Funds payment before December 8, 2023, your organization is still responsible for submitting a Title VI Training and Certification form no later than December 8, 2023. Click here for instructions for submitting Title VI Training & Certification TN Arts Commission’s Title VI Coordinator Project activities occur throughout the year. Grant funds may be obligated toward the funded project when: Requesting Funds First Request for Funds or Requesting all Funds in One Request – Click on the 1st Request for Funds Report and click the Edit button at the top of the page. You may request 40% of your grant award prior to the activity, after there is a fully executed contract and you have submitted Title VI training certification. To do this, choose the 1st Request for Funds option in the drop-down menu, click Save at the bottom of the form, and click Edit again at the top of the page. This will allow the page to populate with the correct form fields for this request. Note that if you are requesting funds for 40% advance of your total award in your first draw, you do NOT have to include check numbers; however the request for advance must be as close as is administratively feasible to the actual disbursement and shall not exceed anticipated expenditures for a 30 day period. Additionally, if you receive an advance, and your project does not occur or your grant is cancelled, your organization will be required to repay the total amount advanced. Complete the form, and click the Save button at the bottom. Once saved, click the Submit button at the bottom of the page. You may choose also choose to request all of your grant funds in one draw. If you have spent your matching funds already and would like to closeout the grant, choose “Closeout” from the drop down menu, Save, and click the Edit button again to show the correct form fields for this request. Then see the Grant Closeout Instructions below. Second and (if necessary) third Request for Funds are drawn down on a reimbursement basis. Provide check numbers in the itemized expenditure section of the Request for Funds Form showing how both grant funds AND matching funds were spent. Most people only request funds twice, 40% at the beginning and then the remainder when the project is over, to avoid the paperwork. However, up to three requests may be submitted. Second and third requests for funds must include an Itemized Expenditures Sheet Annual Grant, which can be downloaded from the Information – Document Library link located in the left-hand menu of the Online Grants System. The Annual Grant Expenditures Form should contain check or receipt numbers where indicated (or CC/DC if payment was made by credit or debit card); sign and date the form before saving and attaching. Once completed, save the form to your computer and attach it to the bottom of the Request for Funds page. Final Request for Funds Deadline – (regardless of whether it is your 1st, 2nd or 3rd) must be submitted no later than 30 days following the project end date or June 15, whichever comes first. Keep records of check or receipt numbers for all grant and match expenditures, as you will have to report this information when closing out the grant. Annual Final Evaluation (closeout) Instructions You will find the Annual Final Evaluation Form in the Grants Management – Report The Annual Final Evaluation form should include final expenses for the entire activity of the grant, not just Arts Commission funds and the category specific required match. The Itemized Expenditures Sheet Annual Grant may be downloaded from the Information – Document Library link located in the left-hand menu of the Online Grants System. The Annual Grant Itemized Expenditures Form should ONLY contain expenditures paid for by the grant and by the minimum category specific matching requirement. Check or receipt numbers must be included where indicated (or CC/DC if payment was made by credit or debit card). Important Closeout Information All grantees are encouraged to participate in arts advocacy efforts during the grant period. Arts Advocacy is communicating to elected officials your views on the importance of the arts and how public support of the arts can and has impacted your community. Examples of arts advocacy may include membership in Tennesseans for the Arts, writing letters to state legislators and other state/local elected officials, inviting state/local elected officials to arts events, and writing newspaper articles that create awareness about public support for the arts through the organization’s activities (news articles that primarily market events are not considered arts advocacy). IMPORTANT: OPERATING SUPPORT RECIPIENTS! If you received any of the following grants your organization is contractually obligated to promote specialty license plates. State of Tennessee

Log on to the grantee portal and fill out the Revised Budget Form. Submit electronically by June 15, 2023 date. We encourage you to submit it as soon as possible.

If the name in this section is not correct, please input the correct information in the available fields.

The primary signatory listed on your grant application will receive and emailed grant contract from the Tennessee Arts Commission for review and digital signature. To reply to this request as soon as possible.

The primary signatory of your organization must respond to the DocuSign email referencing this request with an electronic signature NO LATER THAN June 30, 2023. Failure to respond to the DocuSign request by this date may result in the cancellation of your award.

If you have any questions, please contact the Director of Arts Access/Title VI Coordinator, Kim Johnson, at 615-532-9797 or kim.johnson@tn.gov.

In order to receive funds, you must complete and submit the Request for Funds Form. Funds are generally drawn down in stages. All Request for Funds forms can be found in Grants Management – Reports Due in the left-hand menu of the Online Grants System.

When you have submitted your Final Request for Funds, representing 100% of your grant award, you must close out your grant by submitting an Annual Final Evaluation form, Itemized Expenditures Sheet Annual Grant, and documentation of Tennessee Arts Commission credit. You will not receive payment until all forms and required documentation is submitted electronically. s Due link in the left-hand menu of the Online Grants System.

s Due link in the left-hand menu of the Online Grants System.

FIRST TIME RECIPIENTS, TO EXPEDITE THE PROCESSING TIME OF GRANT PAYMENT REQUESTS:

Attn: Supplier Maintenance

21st Floor WRS Tennessee Tower

312 Rosa L Parks Ave

Nashville, TN 37243