Small Business Administration releases Interim Final Rules on Re-Opening PPP Loans, Allowing PPP Second Draws, and Streamlining Forgiveness

From Nina Ozlu Tunceli, Executive Director, Americans for the Arts Action Fund –

The U.S. Small Business Administration (SBA), in consultation with the Treasury Department, announced today that the Paycheck Protection Program (PPP) will re-open the week of January 11 for new borrowers and certain existing PPP borrowers. To promote access to capital, initially only community financial institutions will be able to make First Draw PPP Loans on Monday, January 11, and Second Draw PPP Loans on Wednesday, January 13. The PPP will open to all participating lenders shortly thereafter. Updated PPP guidance outlining Program changes to enhance its effectiveness and accessibility was released on January 6 (see below) in accordance with the Economic Aid to Hard-Hit Small Businesses, Non-Profits, and Venues Act.

This round of the PPP continues to prioritize millions of Americans employed by small businesses or as independent workers by authorizing up to $284 billion toward job retention and certain operating expenses by allowing certain existing PPP borrowers to apply for a Second Draw PPP Loan. Application deadline is March 31, 2021.

Key PPP updates include:

- PPP borrowers can set their PPP loan’s covered period to be any length between 8 and 24 weeks to best meet their business needs;

- PPP loans will cover additional expenses, including operations expenditures, property damage costs, supplier costs, and worker protection expenditures;

- The Program’s eligibility is expanded to include 501(c)(6)s, housing cooperatives, direct marketing organizations, among other types of organizations;

- The PPP provides greater flexibility for seasonal employees;

- Certain existing PPP borrowers can request to modify their First Draw PPP Loan amount; and

- Certain existing PPP borrowers are now eligible to apply for a Second Draw PPP Loan.

- A borrower is generally eligible for a Second Draw PPP Loan if the borrower:

- Previously received a First Draw PPP Loan and will or has used the full amount only for authorized uses;

- Has no more than 300 employees; and

- Can demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020.

The new guidance released includes:

- Interim Final Rule on Paycheck Protection Program as Amended by Economic Aid Act (Released 1/6/2021)

- Interim Final Rule on Second Draw Loans (Released 1/6/2021)

- SBA Guidance on Accessing Capital for Minority, Underserved, Veteran and Women-Owned Business Concerns (Released 1/6/2021)

More guidelines, application forms and frequently asked questions will be released throughout January 2021. Please check back with us frequently. For more information on SBA’s assistance to small businesses, visit SBA.gov/ppp or Treasury.gov/cares.

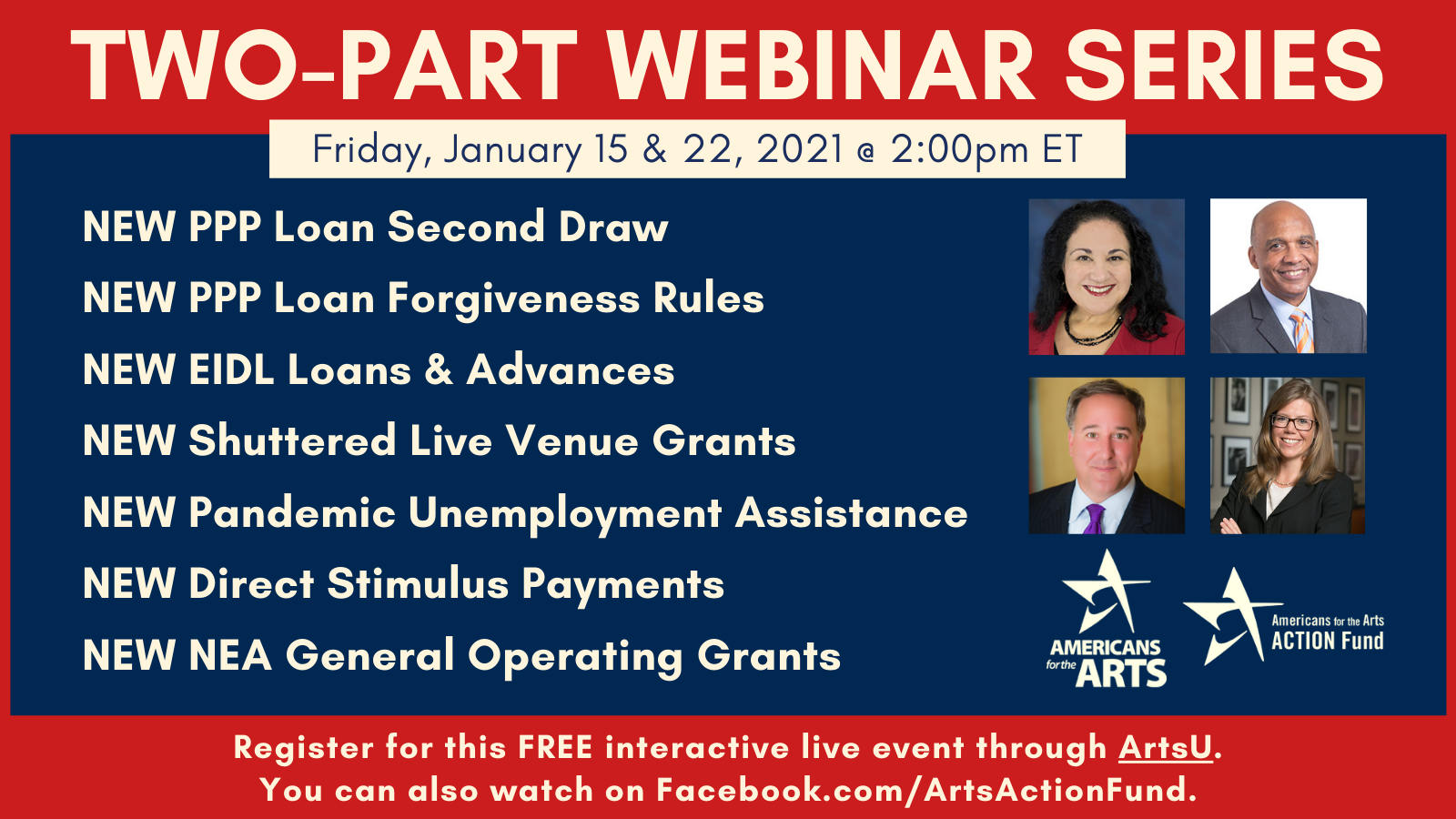

Arts Action Fund and Americans for the Arts will be conducting webinars on these and other COVID-19 Economic Relief Opportunities on Friday at 2:00pm ET on January 15, 2021 and January 22, 2021. Register for FREE at ArtsU or watch live at www.Facebook.com/ArtsActionFund.

The following topics will be covered on the two webinars:

- New SBA Guidelines opening a new round of Paycheck Protection ProgramForgivable Loan Applications, Forgiveness, Tax Implications, and no longer need to deduct EIDL Advances! ($147.5 billion)

- New SBA Guideline creating a second draw of PPP loans to current borrowers ($137 billion)

- New EIDL Loan and Advances – already open to apply now ($20 billion)

- New Shuttered Live Venue Operators and Talent Representatives available to nonprofit, for-profit, and government owned or operated performing arts venues and museums ($15 billion)

- New Pandemic Unemployment Assistance for gig workers, W2 employees, and now “mixed earners”

- New IRS Stimulus Checks of $600 per taxpayer (phasing incrementally out after $75,000 adjusted gross income) and $600 for each of the tax filer’s dependent children 17 years old and younger)

- New expanded and extended charitable tax deductions for non-itemizers up to $300 per tax filer, instead of $300 per tax return. (ie- married, joint filers can deduct up to $600 now)

- New retroactive and upcoming NEA and NEH grants that can be awarded for general operating support.

- New funding for creative arts therapies within the U.S. Department of Defense

Time will be available to ask questions during these two official webinars or you can follow up later to ask your questions during my weekly Zoom Office Hours with Nina throughout 2021 on Fridays at 11:00 a.m. ET.